In today’s digital landscape, ensuring the authenticity of identities is paramount for security and regulatory compliance across various industries. Liveness verification and detection have emerged as critical components of identity authentication processes, addressing the challenges posed by sophisticated fraud tactics. This article explores the significance of liveness verification and detection, the complexities involved, technological advancements shaping reliable identity authentication methods, and practical applications in diverse sectors.

Understanding Liveness Verification and Detection

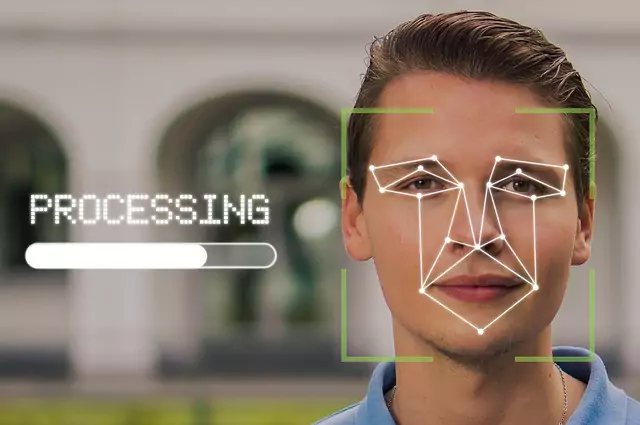

Liveness verification refers to the process of confirming that a person is physically present and actively participating in the authentication process. It prevents fraudulent attempts where static images, videos, or masks are used to deceive identity verification systems. Liveness detection, on the other hand, involves techniques and technologies designed to ensure that the individual undergoing authentication is live and not a simulated representation.

Importance in Identity Authentication

Liveness verification and detection play a crucial role in identity authentication for several reasons:

- Fraud Prevention: By requiring real-time interaction, liveness detection mitigates the risk of spoofing and impersonation. This is particularly important in industries where sensitive information is exchanged, such as finance, healthcare, and e-commerce.

- Regulatory Compliance: Many sectors are mandated by regulations like KYC (Know Your Customer) and AML (Anti-Money Laundering) to implement robust identity verification measures. Liveness verification helps organisations meet these compliance requirements by ensuring the authenticity of individuals’ identities.

- Enhanced Security: Integrating liveness detection technologies enhances overall security measures by adding an additional layer of authentication. This helps protect against identity theft and unauthorised access to sensitive information.

Challenges in Implementing Liveness Verification

Implementing effective liveness verification poses several challenges:

- Technological Complexity: Developing accurate liveness detection algorithms requires advanced technologies capable of differentiating between live interactions and fraudulent attempts accurately.

- Environmental Variability: Factors such as lighting conditions, background noise, and device quality can impact the reliability of liveness detection. Solutions must account for these variables to maintain consistent performance across diverse environments.

- User Experience: Balancing security with user experience is crucial. Authentication processes should be seamless and user-friendly to ensure high completion rates without compromising security standards.

Technological Advancements and Solutions

Recent advancements in liveness detection technology have improved authentication processes:

- Biometric Integration: Utilising biometric sensors, such as facial recognition and fingerprint scanners, enhances the accuracy of liveness detection by capturing unique physiological traits.

- Artificial Intelligence (AI) and Machine Learning (ML): AI-powered algorithms analyze patterns and behaviours in real-time, identifying subtle indicators of liveness such as facial movements or voice dynamics.

- Behavioural Biometrics: Incorporating behavioural biometrics, such as keystroke dynamics or gesture recognition, provides additional layers of verification to enhance overall security measures.

Practical Applications Across Industries

Liveness verification and detection find practical applications across various sectors:

- Financial Services: Banks and financial institutions use liveness detection to verify customer identities during account opening, transaction approvals, and compliance with regulatory requirements.

- Healthcare: Healthcare providers implement liveness verification to ensure secure access to electronic health records (EHRs) and telemedicine services, protecting patient information from unauthorised access.

- E-commerce: Online retailers employ liveness detection to prevent fraudulent transactions and account takeovers, enhancing trust and security for both consumers and merchants.

- Government and Public Sector: Government agencies use liveness verification for citizen authentication in online services, voting systems, and border control applications to prevent identity fraud and ensure national security.

Implementing Effective Liveness Verification Solutions

To successfully implement liveness verification solutions, organisations should consider the following strategies:

- Comprehensive Testing and Validation: Conduct rigorous testing across various scenarios to validate the accuracy and reliability of liveness detection algorithms.

- Continuous Monitoring: Implement real-time monitoring capabilities to detect anomalies and potential fraud attempts promptly during the authentication process.

- User Education and Support: Provide clear instructions and guidance to users on how to complete liveness verification steps effectively, enhancing overall user understanding and compliance.

Future Trends and Considerations

Looking ahead, the evolution of liveness verification technology is expected to continue:

- Integration with IoT and Wearables: Advances in IoT devices and wearables may offer new opportunities for biometric data collection and liveness detection in everyday environments.

- Blockchain and Decentralised Identity: Blockchain technology could enhance the security and privacy of identity verification processes, enabling decentralised liveness verification solutions.

- Regulatory Developments: Continued regulatory scrutiny and evolving compliance requirements will shape the future of liveness verification technologies, influencing their adoption and implementation across industries.

Liveness verification and detection are indispensable for ensuring secure and compliant identity authentication processes in today’s digital era. By leveraging advanced technologies such as Idenfo Direct, organisations can strengthen their defences against fraud, meet regulatory requirements, and deliver a seamless user experience. Embracing these advancements is essential for maintaining trust, security, and integrity in identity authentication across diverse sectors, paving the way for a more secure digital future.