QuantumScape, a US-based battery maker specializing in solid-state batteries, experienced a significant surge in its stock price, rising by 52% following the announcement of a $130 million payment from Volkswagen for technology royalties.

TakeAway Points:

- QuantumScape’s shares shot up 52% following Volkswagen’s $130 million royalty payment, despite doubts about the commercial viability of solid-state batteries.

- Due to market turbulence, VinFast rescheduled the inauguration of its North Carolina factory until 2028 and reduced its sales goal to 80,000 units.

- Due to industrial subsidies, China’s growth in EV production has drawn criticism, which raises questions about potential distortions in the worldwide market.

QuantumScape’s Surge Amid EV Market Challenges

This development provided a rare positive moment for US battery makers, who have faced declining valuations due to slowing electric vehicle (EV) sales and increased competition from Chinese suppliers like BYD and CATL.

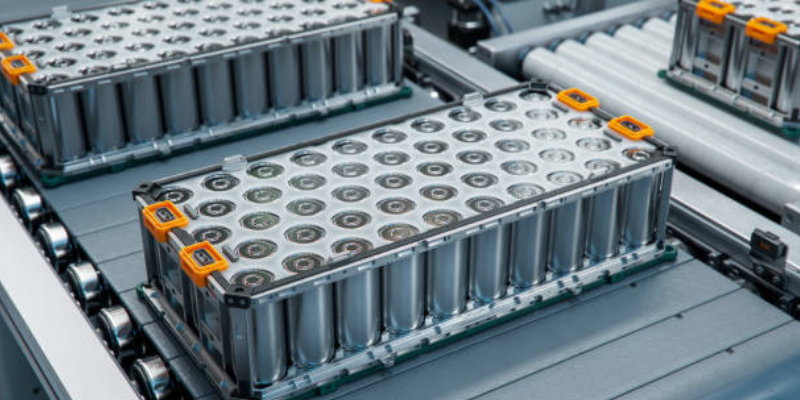

QuantumScape’s CEO, Siva Sivaram, acknowledged the competitive pressure from Chinese companies but emphasized the advantages of solid-state batteries, which offer longer range and faster charging times compared to conventional lithium-ion batteries. However, Wall Street analysts have expressed skepticism about the commercial viability of solid-state batteries. Morgan Stanley noted that the deal with Volkswagen would provide QuantumScape with one to two months of free cash flow but highlighted the lack of a specific timeline for mass production of the battery cells.

Sivaram commented on the fluctuating nature of the automotive business, stating, “The automotive business has these big ups and downs. Yes, there is surely a blip. We just have to ride out these blips.” Despite the challenges, the North American EV market showed resilience, with a 10% increase in EV sales in the first half of 2024 compared to the previous year, according to Rho Motion. Ford also reported a 72% increase in EV sales, making it the second-largest EV seller after Tesla.

VinFast Delays US Factory Opening

Vietnamese EV maker VinFast announced a three-year delay in the opening of its North Carolina factory, pushing the timeline to 2028. The decision aims to manage short-term spending more effectively and focus on near-term growth targets. VinFast also lowered its full-year sales target from 100,000 units to 80,000 units.

“We have adopted a more prudent outlook that is carefully calibrated to near-term headwinds, taking into full consideration the realities of market volatility and potential challenges.” Chairwoman Le Thi Thu Thuy stated.

The delay highlights the difficulties VinFast faces in establishing itself as a global brand amid a deteriorating outlook for the EV market. BloombergNEF’s annual Electric Vehicle Outlook reduced its battery-electric sales projections by 6.7 million vehicles through 2026. Major manufacturers like Ford, General Motors, Volkswagen, and Tesla have also scaled back their ambitions.

Despite the challenges, VinFast remains optimistic about its future. The company plans to focus on “near-term opportunities in a more selective group of potential markets,” aiming to optimize capital and resource management. VinFast’s CEO, Pham Nhat Vuong, expressed his commitment to the company’s growth, stating he was willing to bet all his money on its success. The company delivered 12,058 electric vehicles in the second quarter, a 24% increase from the previous quarter, and expects stronger sales growth in the second half of 2024.

China’s Manufacturing Growth

China’s manufacturing sector, particularly in electric vehicles, renewable energy, and high-tech goods, has sparked two contrasting narratives. One view attributes China’s success to its comparative advantages, such as a large workforce and domestic market. The other view criticizes Beijing’s policies, arguing they distort global markets. The upcoming Third Plenum of the Chinese Communist Party will be a critical moment for China’s leadership to address these concerns.

US Treasury Undersecretary for International Affairs Jay Shambaugh highlighted the issue of industrial subsidies in a recent speech, noting that China spends 5% of its GDP on subsidies, significantly more than other countries. This has contributed to a manufacturing-goods trade surplus approaching 2% of world GDP. Shambaugh warned that failure to address these imbalances could lead to increased trade protectionism.

China’s leadership insists that its industrial growth is a result of organic development and investment in science and technology. Premier Li Qiang emphasized the country’s focus on innovation and product upgrades. However, economists suggest that China could strengthen domestic demand through fiscal reforms, such as improving household incomes and wealth through rural land reform and consumption coupons.